Theory of Production and Cost

The Theory of Production and Costs is one of the cornerstones of microeconomic analysis and focuses on how firms derived production function decisions in a way to maximize their profit and minimize costs. It deals with the study of inputs, especially in the form of labor and capital inputs that go into making, against related outputs of goods and services, and also the cost involved in producing those outputs.

The knowledge of such principles is very important for any business firm to optimize its production processes, efficiently allocate resource supplies, and define price strategies in competitive markets. These important concepts are the production and cost functions that define the input-output relationship and further quantify expenses incurred in the production of goods and services, respectively. With this background, economists and business managers can look into productiveness in production, efficient decisions about resource allocation, and strategy making toward profitability and sustainability.

Theory of Production and Cost in Economics

Production Function:- The production function expresses a functional relationship between physical inputs and physical outputs of a firm at any particular time period. The output is thus a function of inputs.

Mathematically production function can be written as Q= f (L1,L2,C,O,T) Where “Q” stands for the quantity of output and various input factors such as L1 as land, L2 as labour, C is capital ,O is organization and T is technology..

Here output is the function of inputs. Hence output becomes the dependent variable and inputs are the independent variables.

Definition Michall R. Baye “the function which defines the maximum amount of output that can be produced with a given set of inputs.

As part of economics, theory of production and cost investigates how firms mix inputs to make outputs and how this process affects their costs. The course outline is as follows:

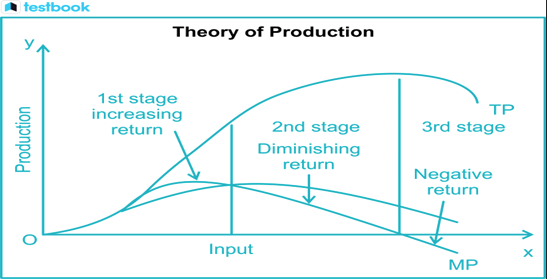

Theory of Production

The theory of production considers the way goods and services are produced from different inputs and seeks to clarify the relationships between various factors of input and different levels of output.

Factors of Production

The factors of production refer to inputs that are essentially required to produce services and goods. They are basically classified into four major factor groups:

- Land: This comprises all the natural resources utilized in production, such as minerals, forests, and water.

- Labour: It is the human effort, skill, and time put into the manufacturing process.

- Capital: Man-made resources used in the production of goods and services, such as machinery, buildings, and tools.

- Entrepreneurship: The ability to combine the other factors of production; to take risks, and to innovate.

Production Functions

A well-defined production function specifies a technical relationship between inputs and outputs and is expressed as Q = f(L, K), where Q is the quantity of output, L is the labor input, and K is capital input.

- Returns to Scale: How output changes when all inputs are varied proportionately.

- Increasing Returns to Scale: Output increases more than the proportional increase in inputs.

- Constant Returns to Scale: Output increases proportionately with inputs.

- Decreasing Returns to Scale: Output will increase less than proportionately as inputs increase.

Short Run versus Long Run

The concepts of short and long run are very important fundamentals in economics, more so when production and its cost are being talked about.

- Short Run: A time period in which at least one of the factors of production is fixed. Firms can alter variable inputs, like labor, as a way of changing the quantity produced. This gives rise to concepts like diminishing returns: eventually, increasing the variable input results in smaller increases in output.

- Long Run: It is a time period wherein all factors of production are variable. Firms are free to vary all inputs and choose optimal production processes. In the long run, the producers also have the options to select an optimal scale of production.

Theory of Cost

Cost theory examines how the production costs determine the behavioral output of the firms in terms of their output and pricing decisions.

Types of Costs

- Fixed Costs: These are the costs that don't vary with the level of output, for example, rent or salaries of permanent staff.

- Variable Costs: These costs directly vary with the level of production; for example, materials and labor for production. Total Cost: Sum of fixed and variable costs at a given level of the produced amount of goods, expressed in TC = FC + VC.

- Marginal Cost: Only the extra cost of producing one additional unit of output, computed by the change in total cost divided by the change in output. (MC=ΔTC/ΔQ).

- Cost Curves Marginal Cost Curve: Generally U-shaped, reflecting development from initial economies of scale and rising due to diminishing returns with increased outputs.

- Average Cost Curve: Also U-shaped, as with output, increase it decreases as fixed costs are spread over more units, and eventually rises as variable costs increase significantly.

Cost Minimization

All firms operate at a level where MC = MR to maximize profit. Determine ways in which an understanding of cost behavior can help firms make production decisions, set prices, and determine output.

Theory of Production and Cost in Microeconomics

The theory of production and cost in microeconomics deals with how firms turn inputs into outputs and associated costs involved in that process. This relation is usually described by the production function, generally expressed as Q=f(L,K), where Q represents the output, while L represents labor, and K represents capital. In the short run, at least one input is fixed, leading to diminishing returns as more of a variable input is added. The long run, however, is a time period over which all inputs are variable, and firms are able to optimize production efficiency. Another related important concept is returns to scale, which describes how output changes when there are proportional changes in all inputs, classified as increasing, constant, or decreasing returns. On the cost side, it views cost functions which include the fixed and variable costs that give rise to a firm's total, average, and marginal costs. These structures of costs are represented by the cost curves—that is, short-run average cost and long-run average cost (LARC)—which help firms understand how costs change with varying output levels. Additionally, economies of scale describe cost advantages of increasing the level of production through efficiencies such as in terms of greater specialization and improved technology. The concepts, in effect, can help firms make quality decisions about resource allocation, production at certain levels, and adopting certain pricing strategies for products or services.

Difference Between Production Theory and Theory of Cost

Here's a comparison between Production Theory and Theory of Cost in tabular form:

| Aspect | Production Theory | Theory of Cost |

|---|---|---|

| Focus | How inputs are converted into outputs | How costs change with varying levels of output |

| Primary Concern | Output maximization | Cost minimization |

| Function | Production function Q = f(L, K) | Cost function (Total Cost, Average Cost, Marginal Cost) |

| Time Frame | Short run vs. long run | Short-run costs vs. long-run costs |

| Inputs | Factors of production (land, labor, capital) | Fixed and variable costs |

| Returns | Returns to scale (increasing, constant, decreasing) | Economies of scale (cost advantages from increased production) |

| Diminishing Returns | Explores the impact of adding variable inputs | Not applicable directly; focuses on cost behavior |

| Application | Guides production decisions and input usage | Guides pricing strategies and profitability analysis |

ECONOMIES OF SCALE –

Marshall has classified these economies of large-scale production into internal economies and external economies. Internal economies are those, which are opened to a single factory or a single firm independently of the action of other firms. Hence internal economies depend solely upon the size of the firm and are different for different firms. External economies are those benefits, which are shared in by a number of firms or industries when the scale of production in an industry or groups of industries increases. Hence external economies benefit all firms within the industry as the size of the industry expands.

Internal Economies: Internal economies may be of the following types.

A). Technical Economies: Technical economies arise to a firm from the use of better machines and superior techniques of production. As a result, production increases and per unit cost of production falls. A large firm, which employs costly and superior plant and equipment, enjoys a technical superiority over a small firm. .

B). Managerial Economies: These economies is developed in a firm or they tremendously growth developed and also expand the firm or organization they need qualified persons to handling each functional specialists. For example Marketing, HR, Finance, Operation etc., on these persons experience the firm will developed and also they can reduce the wastage and increasing production in the long-run.

C). Marketing Economies: The large firm reaps marketing or commercial economies in buying its requirements and in selling its final products. The large firm generally has a separate marketing department. It can buy and sell on behalf of the firm, when the market trends are more favorable. In the matter of buying they could enjoy advantages like preferential treatment, transport concessions, cheap credit, prompt delivery and fine relation with dealers. Similarly it sells its products more effectively for a higher margin of profit.

D). Financial Economies: The large firm is able to secure the necessary finances either for block capital purposes or for working capital needs more easily and cheaply. It can barrow from the public, banks and other financial institutions at relatively cheaper rates. It is in this way that a large firm reaps financial economies.

E). Risk bearing Economies: The large firm produces many commodities and serves wider areas. It is, therefore, able to absorb any shock for its existence. For example, during business depression, the prices fall for every firm. There is also a possibility for market fluctuations in a particular product of the firm. Under such circumstances the risk-bearing economies or survival economies help the bigger firm to survive business crisis.

F). Economies of Research: A large firm possesses larger resources and can establish it’s own research laboratory and employ trained research workers. The firm may even invent new production techniques for increasing its output and reducing cost.

G). Economies of welfare: A large firm can provide better working conditions in-and out-side the factory. Facilities like subsidized canteens, crèches for the infants, recreation room, cheap houses, educational and medical facilities tend to increase the productive efficiency of the workers, which helps in raising production and reducing costs.

External Economies. Business firm enjoys a number of external economies, which are discussed below:

A). Economies of Concentration: When an industry is concentrated in a particular area, all the member firms reap some common economies like skilled labour, improved means of transport and communications, banking and financial services, supply of power and benefits from subsidiaries. All these facilities tend to lower the unit cost of production of all the firms in the industry.

B). Economies of Information : The industry can set up an information centre which may publish a journal and pass on information regarding the availability of raw materials, modern machines, export potentialities and provide other information needed by the firms. It will benefit all firms and reduction in their costs.

C). Economies of Welfare: An industry is in a better position to provide welfare facilities to the workers. It may get land at confessional rates and procure special facilities from the local bodies for setting up housing colonies for the workers. It may also establish public health care units, educational institutions both general and technical so that a continuous supply of skilled labour is available to the industry. This will help the efficiency of the workers. Thus internal economies depend upon the size of the firm and external economies depend upon the size of the industry.

COST ANALYSIS : Profit is the ultimate aim of any business and the long-run prosperity of a firm depends upon its ability to earn sustained profits.. In general the selling price is not within the control of a firm but many costs are under its control. The firm should therefore aim at controlling and minimizing cost. Since every business decision involves cost consideration, it is necessary to understand the meaning of various concepts for clear business thinking and application of right kind of costs.

COST CONCEPTS: 1. Opportunity Cost Vs Outlay Cost: Opportunity cost implies the earnings foregone on the next best alternative, has the present option is undertaken. This cost is often measured by assessing the alternative, which has to be scarified if the particular line is followed. The opportunity cost concept is made use for long-run decisions.

- Fixed and variable costs: Fixed cost is that cost which remains constant for a certain level to output. It is not affected by the changes in the volume of production. But fixed cost per unit decrease, when the production is increased. Fixed cost includes salaries, Rent, Administrative expenses depreciations etc. Variable cost is that which varies directly with the variation is output. An increase in total output results in an increase in total variable costs and decrease in total output results in a proportionate decline in the total variables costs. The variable cost per unit will be constant. Ex: Raw materials, labour, direct expenses, etc.

- Explicit and Implicit costs: Explicit costs are those costs that involve an actual payment to other parties. Therefore, an explicit cost is the monitory payment made by a firm for use of an input owned or controlled by others. Explicit costs are also referred to as accounting costs. Implicit costs represent the value of foregone opportunities but do not involve an actual cash payment. Implicit costs are just as important as explicit costs but are sometimes neglected because they are not as obvious.

- Out-of-pocket costs and Book costs: Out of pocket costs are those costs that improve current cash payments to outsiders. The out-of-pocket costs are also called explicit costs. For example, wages and salaries paid to the employees are out-of pocket costs. Other examples of out-of-pocket costs are payment of rent, interest, transport charges, etc Book costs are those business costs, which do not involve any cash payments but for them a provision is made in the books of account to include them in profit and loss accounts and take tax advantages. Book costs are called implicit or imputed costs.

5. Post and Future costs: Post costs also called historical costs are the actual cost incurred and recorded in the book of account these costs are useful only for valuation and not for decision making. Future costs are costs that are expected to be incurred in the futures. They are not actual costs. They are the costs forecasted or estimated with rational methods. Future cost estimate is useful for decision making because decision are meant for future.

- Traceable and common costs: Traceable costs otherwise called direct cost, is one, which can be identified with a products process or product. Raw material, labour involved in production is examples of traceable cost. Common costs are the ones that common are attributed to a particular process or product. They are incurred collectively for different processes or different types of products. It cannot be directly identified with any particular process or type of product.

7. Avoidable and unavoidable cost: Avoidable costs are the costs, which can be reduced if the business activities of a concern are curtailed. For example, if some workers can be retrenched with a drop in a product – line, or volume or production the wages of the retrenched workers are escapable costs. The unavoidable costs are otherwise called sunk costs. There will not be any reduction in this cost even if reduction in business activity is made. For example cost of the ideal machine capacity is unavoidable cost.

- Controllable and uncontrollable costs: Controllable costs are ones, which can be regulated by the executive who is in change of it. The concept of controllability of cost varies with levels of management. Direct expenses like material, labour etc. are controllable costs. Some costs are not directly identifiable with a process of product. They are appointed to various processes or products in some proportion. This cost varies with the variation in the basis of allocation and is independent of the actions of the executive of that department. These apportioned costs are called uncontrollable costs.

BREAKEVEN ANALYSIS

The study of cost-volume-profit relationship is often referred as BEA. The term BEA is interpreted in two senses. In its narrow sense, it is concerned with finding out BEP; BEP is the point at which total revenue is equal to total cost. It is the point of no profit, no loss.

Assumptions:

- All costs are classified into two – fixed and variable.

- Fixed costs remain constant at all levels of output.

- Variable costs vary proportionally with the volume of output.

- Selling price per unit remains constant in spite of competition or change in the volume of production.

- There will be no change in operating efficiency.

Break Even Point- An analysis to determine the point at which revenue received equals the costs associated with receiving the revenue. Break-even analysis calculates what is known as a margin of safety, The amount that revenues exceed the break-even point. This is the amount that revenues can fall while still staying above the break-even point.

Merits: 1. Break Even Chart discloses the relationship between cost, volume and profit. It reveals how changes in profit. So, it helps management in decision-making.

- It is very useful for forecasting costs and profits long term planning and growth

- The chart discloses profits at various levels of production.

- It serves as a useful tool for cost control.

- It can also be used to study the comparative plant efficiencies of the industry.

- Analytical Break-even chart present the different elements, in the costs – direct material, direct labour, fixed and variable overheads.

Demerits: 1. Break-even chart presents only cost volume profits. It ignores other considerations such as capital amount, marketing aspects and effect of government policy etc., which are necessary in decision making.

- It is assumed that sales, total cost and fixed cost can be represented as straight lines. In actual practice, this may not be so.

- It assumes that profit is a function of output. This is not always true. The firm may increase the profit without increasing its output.

- A major draw back of BEC is its inability to handle production and sale of multiple products.

- It is difficult to handle selling costs such as advertisement and sale promotion in BEC.

Various variables used in BEP, they are:-

- Fixed cost

- Variable cost

- Contribution

- Margin of safety

- Profit volume ratio

- Break-Even-Point

1. Fixed cost: Expenses that do not vary with the volume of production are known as fixed expenses. Eg. Manager’s salary, rent and taxes, insurance etc. It should be noted that fixed changes are fixed only within a certain range of plant capacity.

2. Variable Cost: Expenses that vary almost in direct proportion to the volume of production of sales are called variable expenses. Eg. Electric power and fuel, packing materials consumable stores. It should be noted that variable cost per unit is fixed

3. Contribution: Contribution is the difference between sales and variable costs and it contributed towards fixed costs and profit. It helps in sales and pricing policies and measuring the profitability of different proposals. Contribution is a sure test to decide whether a product is worthwhile to be continued among different products.

Contribution = Sales – Variable cost Contribution = Fixed Cost + Profit.

4. Profit Volume Ratio is usually called P. V. ratio. It is one of the most useful ratios for studying the profitability of business. The ratio of contribution to sales is the P/V ratio. It may be expressed in percentage. The concept of P. V. ratio helps in determining break even-point, a desired amount of profit etc. The formula is, Sales Contribution X 100

5. Break – Even- Point: If we divide the term into three words, then it does not require further explanation. Break Even Point refers to the point where total cost is equal to total revenue. It is a point of no profit, no loss. This is also a minimum point of no profit, no loss. This is also a minimum point of production where total costs are recovered. If sales go up beyond the Break Even Point, organization makes a profit.

Significance of BEP

Breakeven point analysis is a very important tool, especially if you are preparing a business plan, to figure out the volume of sales your arts and crafts business needs to make in order to cover both your variable and fixed costs. At breakeven point, your arts and crafts business has made or lost no money. Important info for you as the business owner is you have to be able to hand craft your arts and crafts items at a price that your customers will pay while still providing an adequate amount of income to cover your personal living expenses. Once you get the hang of it you will find it quick and easy to figure breakeven point using an Excel spreadsheet.

Breakeven Analysis

- BEP = No Profit, No Loss Point

- Formula:

BEP (units)=Fixed CostPrice per unit – Variable cost per unit\text{BEP (units)} = \frac{\text{Fixed Cost}}{\text{Price per unit – Variable cost per unit}} BEP (units)=Price per unit – Variable cost per unitFixed Cost

Key Terms:

- Contribution: Sales - VC

- P/V Ratio: ContributionSales×100\frac{\text{Contribution}}{\text{Sales}} \times 100SalesContribution ×100

- Margin of Safety: Actual Sales - BEP Sales

Conclusion

In sum, the Theory of Production and Costs delivers important theoretical frameworks and tools to business principals for running organizations in the marketplace. These describe the dynamics of input relationships and the structure of costs in relation to profit maximization strategies. It is then that these theoretical insights become relevant in enhancing productivity, controlling the escalation of costs, and adapting more appropriately to changing market circumstances. In other words, a betterment of economic theory and continuation of empirical research in these respects mean only one thing: our understanding of the production process and cost dynamics improves, therefore informing decision-making and sustainable business practice in an increasingly complex global economy

Copyright © 2025 Manupatra. All Rights Reserved.

Toll Free No : 1-800-103-3550

Toll Free No : 1-800-103-3550 +91-120-4014521

+91-120-4014521